The Impact of Google’s Latest Mobile Updates

Earlier in August, Google unveiled multiple changes to their mobile market that will significantly impact overall paid search marketing strategies. First, cross device conversions will now automatically be tracked under all conversions within AdWords. Second, Google will be making long-awaited changes to their device level bidding. Both of these updates will allow more control over the mobile market, as well as the ability to attribute mobile performance more appropriately and make more informed decisions.

Although mobile traffic is on the rise, customers are constantly researching before they buy, and often times, this research can occur on multiple devices. For example, if you are looking to purchase a new camera, you may do some initial research on your mobile phone during your work commute, but then finally take the plunge, and purchase later that day on your desktop. According to Google, 61% of internet users, and a whopping 80% of online millennials will start shopping on one device, and then purchase on another. When using AdWords conversion tracking, the purchase from the example above would get attributed as a desktop conversion. However, in reality, that purchase was initiated on a mobile device. Cross device conversions allow for proper tracking and the understanding of where conversions are coming from. As of September 6th, Google is now automatically tracking cross device conversions within all conversions in AdWords. Cross device conversion tracking is likely to cause paid search marketers to see the true influence of mobile, which is often under-valued.

Now that we are able to see to real impact of mobile performance on our campaigns, Google’s latest announcement is going to allow marketers to cater their marketing strategies to revolve more around mobile performance. Previously, users were only allowed to adjust their mobile bids, by applying a blanket bid multiplier to campaigns or ad groups, while desktop and tablet bids were grouped together. In the next few months, Google will be unveiling a brand-new strategy which will allow users to set baseline bids regardless of the device. Therefore, bids can be set specifically for mobile, with desktop or tablet bid multipliers applied vice versa. Users will have the ability to adjust bids up to 900% for each device. Now, advertisers can create mobile, desktop, or tablet specific campaigns with unique ads and bids designed to target specific markets.

These two new Google updates go hand in hand in letting paid search marketers have a deeper understanding of mobile performance for their accounts, with the ability to actually take action on their strategies. Cross device conversion tracking lets us realize what keywords or ads perform best on certain devices, and soon, we will be able to fully optimize our bids based on this data. And last but certainly not least, perhaps the most long-awaited change, is that we can finally set negative bid adjustments on those pesky tablets.

If you are interested in learning more about how you can more effectively leverage a mobile bidding strategy, please contact us by email at sales@synapsesem.com or by phone at 781-591-0752.

What Role Do View-Through Conversions Play in the Display Network?

Just about everyone who has used the internet is familiar with seeing those pesky Remarketing ads. In fact, every time I tell someone that I work in the digital marketing field, it almost is directly followed by the same question, “Are you the ones that make those creepy ads that follow me around on every site?”

Over the years, I found that it is not just my friends and family who are annoyed about Remarketing ads, but CMOs and marketing executives are often asking the same question. Does Remarketing really work? If someone visits a site, is seeing an ad in the corner of their computer screen really going to influence them to visit it again?

Remarketing campaigns can produce two different types of conversions. The first conversion type is a direct conversion, where a user views a remarketing ad on a separate site, clicks directly on it, and then converts. The other, more controversial conversion, is a View-Through Conversion (VTC). This occurs when a user views a remarketing ad on a separate site, does not click on it, and at another time, navigates back to the original site through another channel (organically, directly etc.) and converts.

The question that then arises is, do VTCs really represent incremental sales and leads? How do we exactly know that the ad generated the conversion? With VTCs, the individual can end up back on the original site, days or sometimes weeks after they first saw that specific ad. What are the chances that that specific remarketing ad really prompted that conversion? How are we so sure that the user was not already planning on returning to the site? Additionally, a user may not have even seen the ad. Many times advertisements are located below fold on a site, or hidden away on side banners. It is likely that the user could have missed the ad completely.

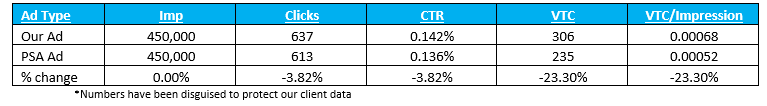

Our agency set out to conduct an A/B test designed to prove whether or not VTCs are really influencing our performance. To do so, our agency worked with Google to set up a PSA test. Google carefully segmented our audiences into two groups: one group that will exclusively see an irrelevant public service announcement (PSA) advertisement, and another group that will see our client’s image ad. The audiences were set specifically so that there would be no overlap between who sees what ad. Check out the results below:

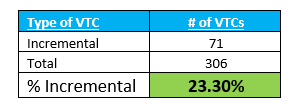

Of all the users that were part of the remarketing list, and did not get remarketed to (saw the PSA ad), we generated 235 VTCs. Of all the users that were remarketed to normally (saw a client specific ad), we produced 306 VTC. Therefore, we can assume that our remarketing ads produced an incremental 71 VTCs (if we subtract 235 from 202). The 71 VTCs makes up roughly 23% of overall VTCs (306). Of course this percentage will vary with each client and industry.

We can now apply this 23% to our total VTCs in order to more accurately determine the number of truly incremental VTCs. For example, if in a given week, a remarketing campaign produced 133 VTCs, it is likely that 30 of those conversions are legitimate. If you are an ecommerce company, you can apply standard AOV numbers to calculate the expected incremental revenue that those VTCs added to your campaigns. Whether you are a strong proponent of VTC, or a skeptic, it is important to consider the findings of this test and learn that we can quantify the impact of VTCs. These findings should be considered in reporting and they should influence optimizations within Display and Remarketing campaigns. It is important that we do not neglect these forms of conversions that can sometimes be considered illegitimate or non-incremental. Raising bids of display placements, keywords, or other targeting based on VTC volume has proven successful in impacting our overall client conversions. Ultimately, we know that across Display and Remarketing campaigns some of the VTCs are incremental and some are not. As advertisers, it is critical that we understand this rate of incrementality so that we’re properly attributing the correct value to each of our marketing programs. Furthermore, each network and each campaign type (display vs. remarketing) may produce different rates of incrementality. Therefore, it is important to test various networks and campaign types to understand how VTCs behave within each.

To learn more about Display and Remarketing strategy, please contact us by email at sales@synapsesem.com or by phone at 781-591-0752.

Why First Click Attribution is Critical For E-Commerce Companies

Picture yourself searching online for that special, “stand out” birthday gift for your dad, who is not exactly easy to impress. You may start off searching for “best gifts for dad.” This search leads you to click on a paid search ad, advertising the perfect watch for Dad. Right then and there, you click “buy now,” plug in your credit card, and boom…you’re done. While for some impulsive folks this may sound normal, most people don’t buy the first thing they click on. The more common scenario might be that you do click on that PPC ad, but decide to take some time to think it over. After all, that watch isn’t exactly in your budget. The next day you see a remarketing banner for the watch, which reminds you that Dad’s birthday is fast approaching. You click on that ad, but still want to explore other options. Two weeks later, you’re in a time crunch. Dad’s birthday is next weekend. Your quickly type in the name of the watch into Google, and organically navigate to the site to purchase.

Right now, most digital marketers live in a “last click” world when it comes to optimizations and reporting. In this world, the last step or last interaction a user has before the conversion, in this case the organic search, gets all the credit. For many organizations this is a deeply flawed reporting methodology. There are five core traffic sources or “channels” that drive traffic to your website. The perception is that these channels operate by themselves and single handedly generate conversions and sales. While this is sometimes true, in the world of e-commerce, it is not common.

A user often interacts with multiple channels, like we saw in the example above, before becoming a customer. So the question then arises: which channel should get the credit for producing a conversion, or conversely, the blame for failing to produce a conversion? In the digital marketing world, it is crucial that we take into consideration first click attribution as a primary attribution model when reporting and making optimizations. You may say, OK, isn’t this just a different format of reporting or presenting data? The answer to that question for e-commerce businesses is no. When using first click attribution, we can see what specific keywords are driving traffic and ultimately, producing revenue. This can lead us to revisit where we are allocating budget and more importantly it can reveal “low hanging fruit” optimization opportunities that are often masked when using last click attribution.

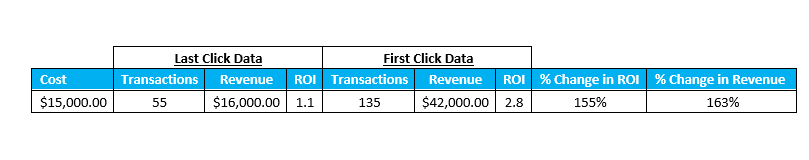

To see this in more detail, let’s take a look at an example.

The following example represents revenue disparity between first click and last click performance for just one non-branded keyword. Last click ROI and revenue volume wrongfully indicate that the term is inefficient (based on an ROI goal of 2) and would require significant bid reductions to cut overall spend and increase profitability. For any digital marketing strategist, this would be an obvious optimization. However, if we look at first click attribution as an option, it tells a significantly different story. As you can see, the keyword drives 163% higher revenue with a significantly better ROI. We can now use this data to take action. By increasing bids, we can drive incremental revenue and growth on a term we previously were not capitalizing on.

Spending time looking at different attribution models and finding out what model fits your company best is crucial for any digital marketer. Identifying first click attribution as an option can be the first step in unlocking an abundance of revenue driving opportunities. For a relatively unknown e-commerce company, first click data can be key in discovering what is driving overall brand awareness and educating users about the company itself or the products it sells. For example, a brand new coffee bean company may utilize first click attribution data to see what terms are generating interest in their product and driving users to their site. However, a massive company like Macy’s already has developed a brand, and is most likely only interested in what marketing channel is driving that final sale, not how a user originally found their site.

You can easily start looking at various attribution models in Google Analytics. The Model Comparison Tool allows you to compare attribution models to see what keywords or campaigns are significantly contributing to revenue. This easy-to-access insight can be an important in helping make sure you’re making correct marketing decisions and maximizing the impact of each marketing channel.